Real-Time Reporting

Real-Time Reporting

Maintaining control over business expenses and managing financial resources efficiently is paramount to the long-term success of your business, but nonetheless is still a challenge for many businesses, both large and small. One tool that has proved invaluable in this endeavor is the expense report—a financial record of costs incurred over a specific time period.

With a detailed breakdown of how and where company money is being spent, organizations are more equipped to understand, protect, and grow their cash flow, and plan their financial future. It sounds simple enough in theory, but not always effective in practice.

In this blog post, we dive into the role of expense reports in business, the challenges of traditional expense reporting, and the ways new financial technology make reporting expenses easy and more effective than traditional methods.

Consistently achieving these goals does not go without challenges though—especially when businesses rely on manual processes.

Paper receipts can go missing. Employees may not get their expenses submitted in time or at all. Perhaps, a transaction is miscategorized by mistake, an employee typed in one too many zeros when manually entering the expense data, or an expense claim gets duplicated. These types of mistakes can cloud transparency, complicate reconciliation, interfere with budget decisions, and in more drastic instances, result in legal issues.

Fortunately, these mistakes can be mitigated and even eliminated all together with the help of digital spend management solutions.

Traditionally, expense reporting was a labor-intensive, error-prone, complex process—for some, it still is.

However, the sophistication of financial technology paired with corporate credit or debit card options has revolutionized this aspect of business finance. Now, expense reporting can be more efficient, clear-cut, actionable, and user-friendly for everyone.

Here are a few game changing solutions businesses can take advantage of:

One of the most significant advancements in expense reporting is the transition to real-time reporting. Instead of waiting for employees to submit paper receipts and manually processing them one-by-one, businesses can now capture expenses as they occur in a few different ways.

Most people today are used to logging into banking portals or mobile banking apps to review personal purchases and finances. The same capabilities, plus more, are available for business expense management.

Company credit or debit cards integrated with digital financial systems can automatically record, categorize, and organize expense data the moment a purchase is made. This reduces the administrative burden and minimizes the risk of errors associated with manual data entry. This eliminates the risk of lost receipts and ensures that expenses are recorded accurately and promptly.

Still, your company may require receipts to verify the accuracy, policy compliance, of each purchase. The power to submit receipts in real-time is right our pockets.

With card-based mobile banking apps like U.S. Bank Spend Management, employees can either take a photo of a paper receipt or screenshot a digital receipt, upload the photo directly into the app. Then, the software will automatically pair the receipt to the corresponding transaction. Additionally, organizations can configure alerts that remind employees via email, SMS, or push notification to upload their receipts.

Some of the frustrations that frequently come up with traditional expense reporting revolve around expense policies, enforcing them, and resolving non-compliant expenses.

For instance, let’s say an employee is on a work trip, and at the end of it they submit all their expenses, but are told that there some purchases that don’t comply with the business’s expense policy. That money has already been spent and the employee may end up taking the hit for those charges, which is not necessarily great for morale.

Sure, you can communicate your expense policy and expect employees to follow it until you’re blue in the face, but there are bound to be slip ups. Instead of retroactively disapproving non-compliant expenses, businesses can (and should) be proactive.

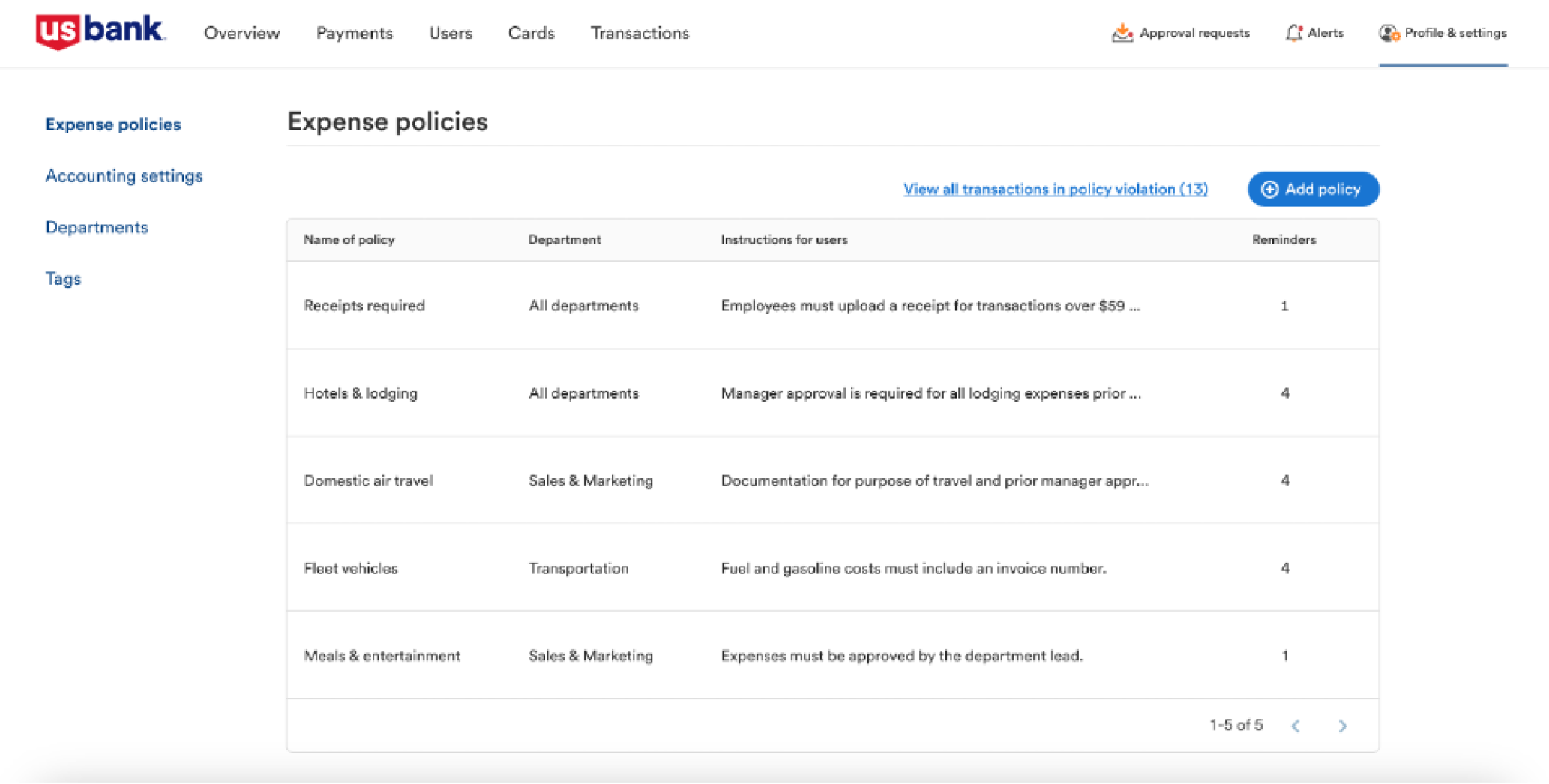

With U.S. Bank Spend Management and similar systems, organizations can enforce company expense policies in real-time and flag non-compliant expenses as they are submitted, helping to prevent wasteful spending and promote compliance.

Additionally, organizations can set up controls rules for each individual card based on the card holder, their department, spending amount, spending period, merchant, merchant category, and more to further ensure that employees are only making authorized purchases.

Having a repository of accessible and actionable data is critical for effective budgeting and financial planning. As we previously mentioned though, traditional expense reporting can result in scattered and incomplete information.

Spend management solutions takes the real-time expense data, consolidates, categorizes, and transforms it with analytics and reporting features. U.S. Bank Spend Management, for instance, offers a 360 dashboard that provides a complete overview of total spending over a specific time period, plus options to view spending by merchant categories, vendors, departments, and users.

With single source of truth for all employee expenses and options to generate custom reports, executives and budget stakeholders gain the visibility and insight into spending patterns needed to make more effective financial planning, cash flow projections, and allocation decisions.

To illustrate the impact of real-time expense reporting and the spend solutions discussed above, let’s look at the results a hypothetical before and after example.

Out with the old way of expense reporting, in with the new.

Selecting the right spend management and expense reporting solution will vary from business-to-business but there are a few key considerations to bear in mind:

Effective expense reports are a cornerstone of financial visibility and control for businesses. They give stakeholders transparency, aid in budget management, inform financial planning and decision-making, ensure tax compliance, and prepare companies for audits. With the advent of real-time expense reporting technology, businesses have an opportunity to further enhance their financial management processes.

By transitioning from traditional expense reporting processes to digital, real-time options, businesses can capture expenses as they occur, automate data entry, enforce expense policies, and gain valuable insights through analytics. This not only improves financial visibility and control but also empowers businesses to make more informed decisions and allocate resources strategically.

In a rapidly changing business landscape, the ability to adapt and leverage technology is a competitive advantage. Embrace the financial tech options and move toward a more efficient, agile, and financially secure future for your organization.